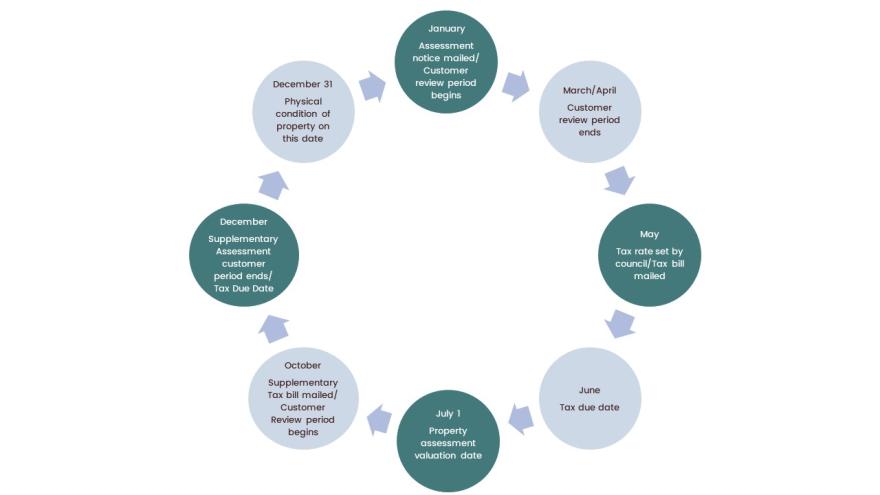

Your property assessment helps determine your share of municipal, education and seniors’ housing taxes. Assessments reflect the estimated market value of your property and ensure fairness in tax distribution across Cochrane.

Residential property inspections

Cochrane follows a five-year re-inspection cycle to ensure accurate property data.

Residential property verification forms are sent to property owners from July to September based on this rotating cycle. If you receive a form, review your details and submit updates using the Residential Property Verification form.