The Tax Installment Payment Plan (TIPP) spreads your property tax payments out over 12 monthly installments instead of requiring a lump sum payment in June. Payments are automatically withdrawn from your account on the 15th of each month.

TIPP makes budgeting easier and helps you avoid penalties. No extra fees or interest payments are charged for participating in TIPP.

Register for TIPP

- Complete the TIPP Registration form.

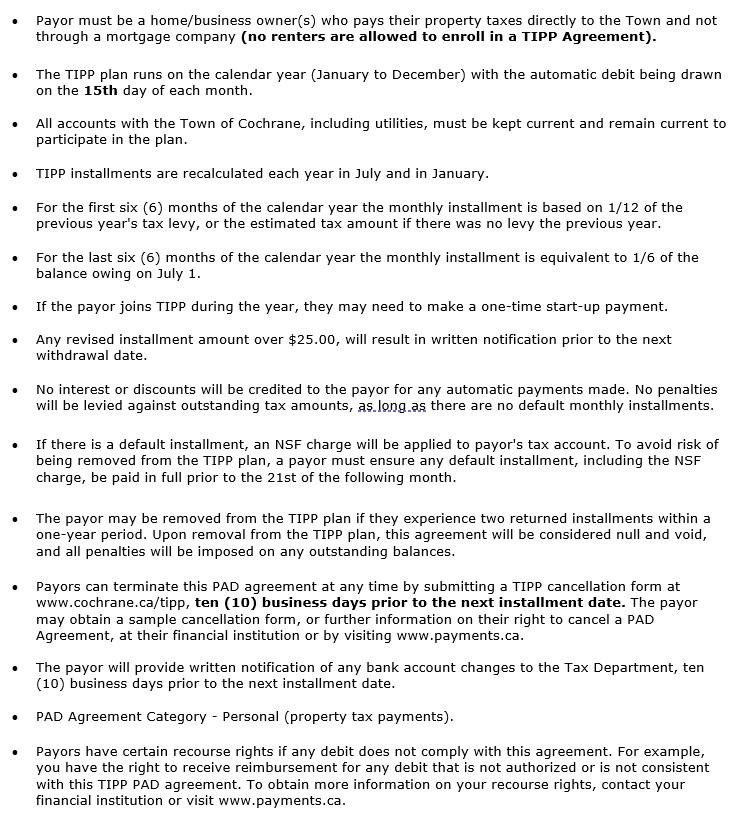

- Once your registration form is received, an email will be sent to you with an application and next steps on how to complete your enrollment in TIPP. Agree to the terms and conditions of the plan, one of which is that all accounts with the Town must be current and remain current to participate in the plan.

- Agree to the terms and conditions, including keeping all accounts with the Town current.

- Complete and submit your application before the “return by” date listed.

- Provide a void cheque or a print out of your banking information.

- Make your applicable start-up payment by the “return by” date.

If you own more than one property, complete a registration for each location that you would like to enroll in TIPP. If payments are withdrawn from the same account, only one void cheque is needed.

Cancel TIPP

You can cancel your TIPP payments anytime by completing the TIPP Cancellation form.

Your cancellation must be submitted at least 10 business days before the next TIPP installment date.

Change of Banking Information - TIPP

To change your banking information, complete and submit the Change of Banking Information form at least 10 business days before the next TIPP installment date.