What is a supplementary assessment?

A supplementary assessment applies to a newly constructed property that is completed or occupied during the current tax year. This ensures that newly built homes and buildings contribute fairly to municipal services.

How is the supplementary tax calculated?

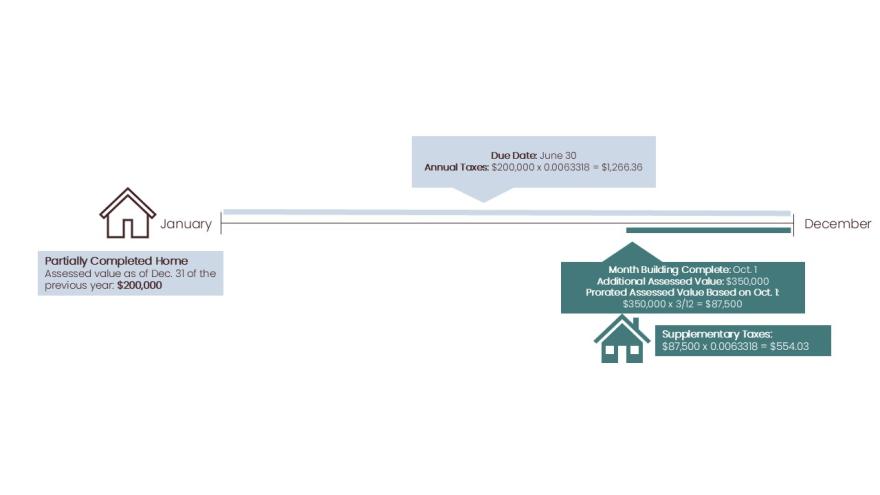

The supplementary tax is based on the increase in property value between the property’s annual assessment (value as of the prior year-end) and the value upon completion or occupancy.

Taxes are then prorated based on the number of months the property was completed or occupied.

Supplementary assessments and tax bills are mailed no later than Oct. 31. Payments are due Dec. 31.

If you have questions regarding your property taxes contact our property tax department:

Phone: 403-851-2288 Email: taxes@cochrane.ca

Example assessment for 2025

Questions?

Property assessments

If you’ve reviewed and compared your assessment and still have questions or concerns, reach out to an assessor.

Changes to assessments will be considered only if the inquiry is received during the legislated time frame.

If you’re not satisfied after speaking with an assessor, you may file a formal complaint with the Assessment Review Board. Formal assessment complaints must be submitted within the 60-day review period.